Charity Benchmarks 2022: the results

How have short-term crises and long-term challenges impacted fundraisers and their causes? Read the Charity Benchmarks 2022 highlights to find out - and what to do about it.

In June 2023 we hosted the fifth Charity Benchmarks project; taking into account hundreds of millions of pounds of income and data from some of the UK’s most-loved charities, providing fundraisers with the insights and information they need to raise more money for their cause.

And what a five years it’s been.

From pandemic to war, a cost of living crisis, and the threat of recession, it’s been a tough few years for charities.

And we’re not out of the woods yet.

Here we’ll share the key highlights of our 2022 analysis and what it means for your team and fundraising. Download your free copy of the report here to see more of the data in detail.

You can now get involved with Charity Benchmarks 2023 to receive a personalised, detailed copy for your own charity or add your data to Charity Benchmarks 2022. Chat to Liz Campbell-Black to find out more.

The big picture

Even in our earliest reports, we got a sense of a burning platform with proven acquisition channels becoming overused, saturated, and slowly declining in performance.

Then along came Covid and with it an opportunity to innovate – we became more digital, it changed the way we integrated, and it changed the way we worked.

But it did put huge pressure on fundraising – and it's really pretty tough out there.

Costs are increasing, people are on strike, and an economic downturn is impacting almost every charity around the world.

So fundraisers want to know, what was the impact of all these extreme factors on fundraising in the UK?

Charity Benchmarks 2022 analysed £929 million of income from UK charities and surveyed the wider sector to get those answers.

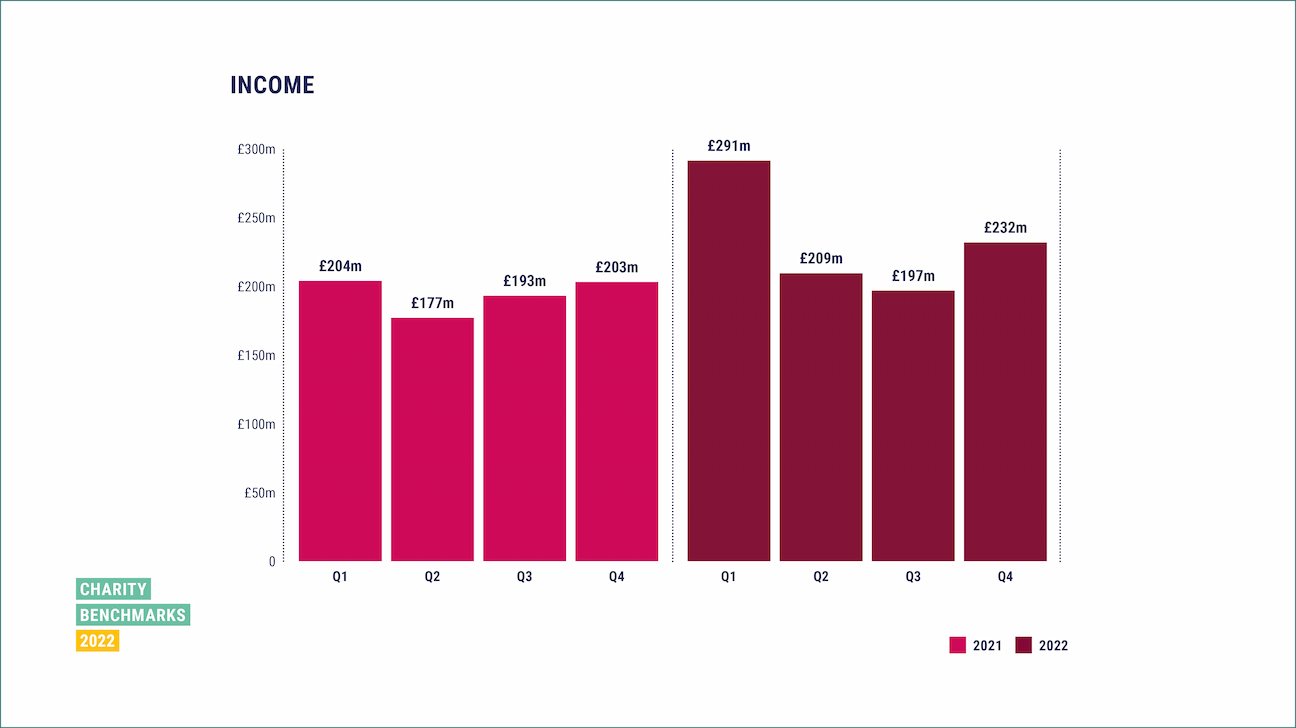

Income is up, but it’s too soon to celebrate

In Q1 of 2022, a usually subdued time for fundraising, the sector saw an enormous income spike in donations to support the people affected by the war in Ukraine.

But even without this income, we did experience growth across 2022 which is definitely something to celebrate. Especially with Q4 holding up income figures for many charities despite the cost of living crisis at the front of everyone’s minds.

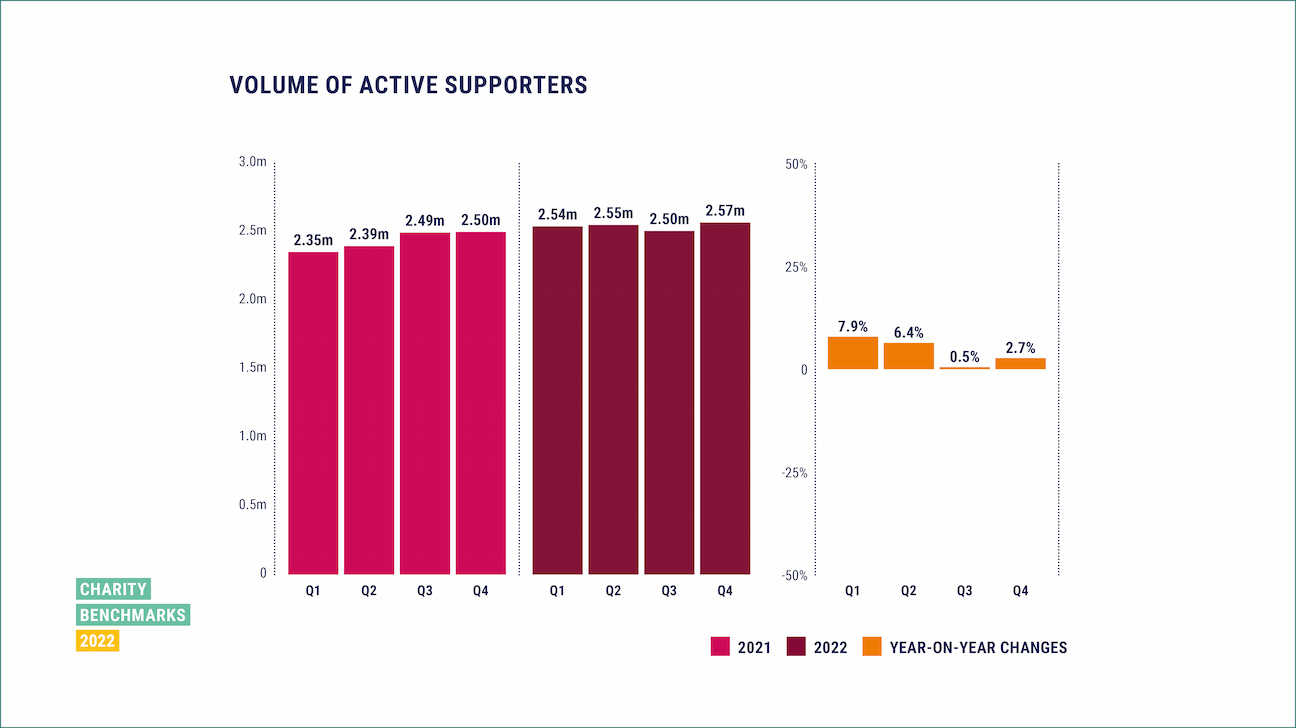

And if we continue with the good news, the number of supporters our organisations have is also up by about 70,000 for the charities involved in this year’s study. This a small increase, but good news considering the sector was preparing for the worst.

However, the rise in inflation (13% in 2022 Q4) was more than the fundraising growth we achieved and costs rose as the value of the pound decreased.

And donor recruitment was down Q1-Q3, being boosted only in Q4 with end-of-year fundraising and Christmas appeals.

The impact of our hard work was eroded as we clawed back our fundraising.

Charity Benchmarks participants do receive detailed data about the correlation between their fundraising spend and income by income stream, but for the wider sector we can only share that spend has risen significantly from £99 million to £130 million since 2021.

We’re running to stand still, and we’re spending an awful lot more money to chase down the same amount of net income.

To receive a detailed analysis of your fundraising activity for 2022 and 2023 to discover what you need to do about this challenge, join Charity Benchmarks.

We need stronger teams

The greatest internal challenge for our sector is ‘people’ with 29% of survey participants considering a move out of the sector for their next role. There are a number of great fundraisers already leaving our sector and participants acknowledged it is difficult to keep morale high and reduce burnout.

When asked about hybrid working 80% said that they were happy – but almost 50% of participants told us they struggled with silo working and would like to see a better infrastructure to facilitate the great opportunities it presents.

Alongside that, 70% don’t think we’re doing enough to promote diversity and inclusion among fundraising practitioners – so we need to do more and make this a focus within the sector.

We need to make teams and people a priority. The ambitious goals of our future can’t be achieved without them.

What are the current challenges?

The overview of 2022 is not as bad as we expected with income on the rise – but it’s not the full picture.

ROI is dwindling as the pound falls and inflation rises; our cost rises are out-pacing our income.

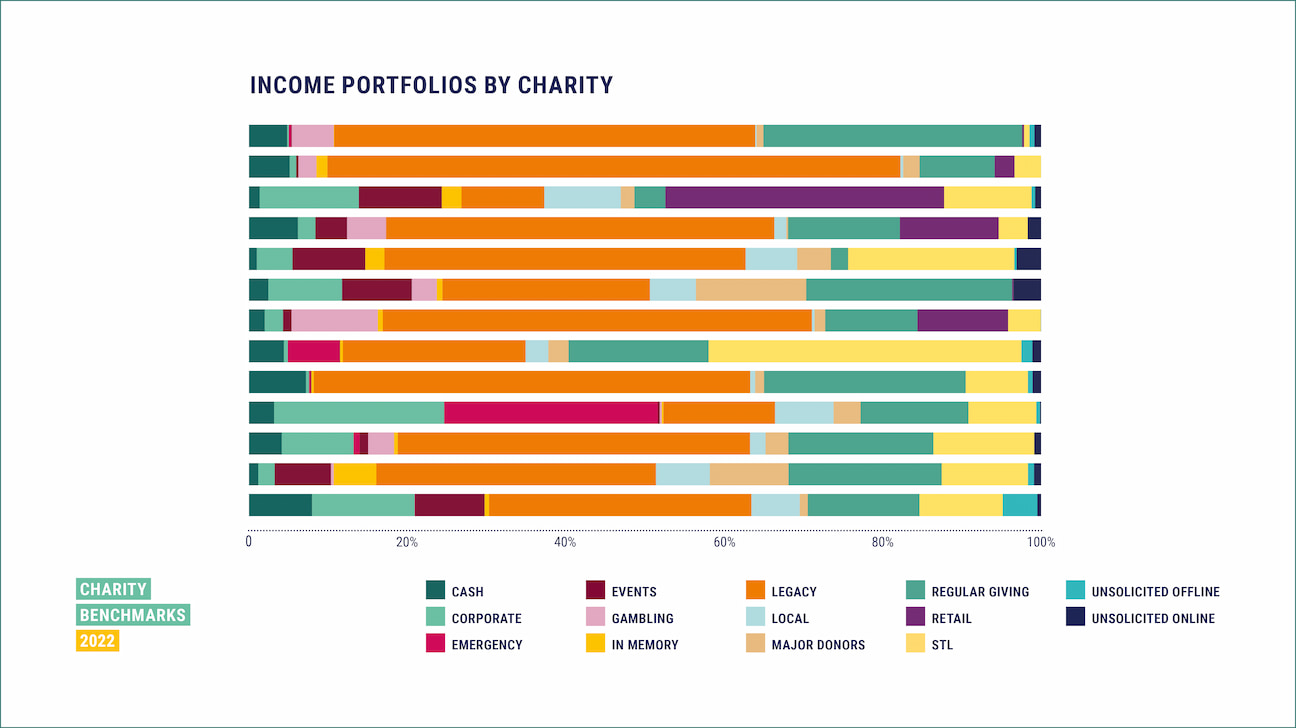

Delving into the data a little bit deeper, we can also see that half of the income for our participating charities is from legacies. Income that is the result of hard work done in previous years.

Without this legacy income growth, overall income across the sector actually fell by £38m (6%). A stark reminder of the urgency to innovate and repair recruitment and retention strategies and tactics that are no longer working.

Cash giving also fell by £5.4m for our Benchmarks participants between 2021 and 2022, resulting in missed opportunities for future stewarded giving.

Are we running back to the burning platform?

Regular giving income keeps on coming and volumes did increase slightly in 2022 but the rise was modest.

Whilst the cost per gift and donor numbers are up, we still have the challenge of maintaining successful recruitment methods. During Covid-19 charities got very good and invested a lot of money in online giving – and the results spoke for themselves.

But now we are experiencing charities piling back to offline methods and it’s a shame to see innovation and progress fall backward at a time in our sector's history when innovation and long-term goals for success are necessary.

Where are the opportunities?

Despite the numerous challenges and uncertainties, the priorities of participating charities were still centered around growth with growing income and supporter recruitment topping the list and improving retention rates third.

The opportunities identified by charity leaders for fundraising in 2023 are,

- Digital fundraising

- Artificial intelligence

- Corporate relationships and utilising purpose-related messaging in campaigns

- Understanding and harnessing the changing needs of our generational audiences and the potential for co-creation

54% of our participants expected to improve ROI in 2023 (despite it falling really significantly in 2022) – but this appears to be at odds with the challenging external environment and potential team changes expected by 54% of Charity Benchmarks participants.

Could this ambition clashing with reality be contributing to the falling morale of fundraisers highlighted in our data?

If we do what we’ve always done, we’ll get what we’ve always got

We were hoping for a return to a (new) normal. But it didn’t quite work out that way…

2022 saw war break out in Europe and the onset of a global economic crisis – which saw demand for charities’ services increase along with their costs.

So let’s celebrate the fact that, despite all this turmoil, the gross income numbers for 2022 don’t look too bad. But once we’ve raised a glass, we have work to do because, as always with data, the devil is in the detail.

Yes, we’re still in growth. But that growth is coming almost exclusively from legacy income. As channels open up and inflation bites, costs are rising. And it feels like our people are tiring.

Moreover, there’s evidence that after the enforced agility and innovation of the pandemic years, frazzled fundraisers are drifting back to the tried and tested methods of the past.

And these are the methods which, if you can remember that far back, fundraisers described as a burning platform when we started this project in 2017.

It’s a challenging world and it’s more important than ever to have as much information and insight as possible. That’s why we’re sharing a selection of our findings in this report and why it’s more important than ever that YOU take part in future versions.

So please get in touch and be part of the project - you can add your data to the existing study and we’re recruiting participants for Charity Benchmarks 2023 with a £500 discount available if you sign up before 31 August 2023.

Contact Liz Campbell-Black to find out more.

Download a copy of the condensed report for free here.

“We're running to stand still, and we're spending an awful lot more money to chase down the same amount of net income.”